Press Conference on Unbearably High Interest of 22% and Cost of Doing Business Saquib Fayyaz Magoon, Acting President FPCCI

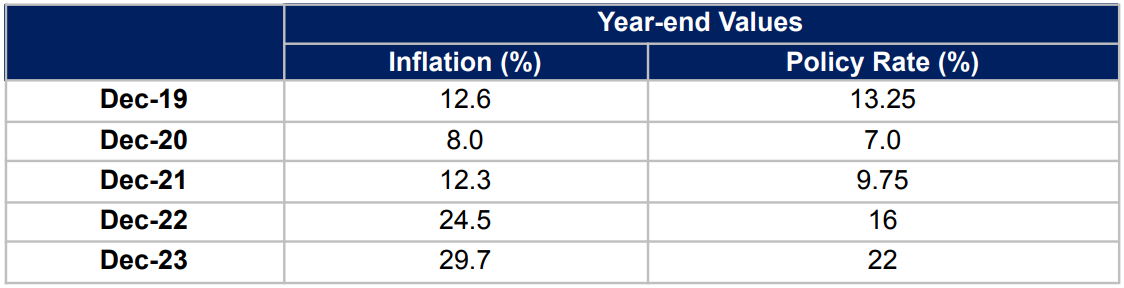

Mr. Saquib Fayyaz Magoon, Acting President FPCCI, has said that the country's economy has suffered record-high inflation and an economic slowdown compounded by devastating floods last year. Persisting double-digit inflation, despite Pakistan's contractionary monetary approach, has raised concerns regarding monetary decisions.

The sharp increase in prices can be attributed primarily to several factors on the supply side, including elevated international commodity prices, disruptions in global supply chains, crop damage due to floods, currency devaluation, and domestic political uncertainty. Despite these supply-side challenges, the State Bank, following IMF recommendations, has primarily employed demand-side measures such as policy rate adjustments to address the issue of double-digit inflation. This approach contradicts international practices.

The effectiveness of increasing policy rates as a tool for controlling inflation is questionable. For example, even after a significant increase in the policy rates by 1500 basis points, from 7% in August 2021 to 22% in February 2024, inflation continued to rise sharply, escalating from 8.4% to 23.1% during this period, indicating a potential misalignment between policy measures and inflationary dynamics.

The adherence to the generic set of measures prescribed by IMF programs has not successfully addressed the inherent structural issues within the Pakistani economy, leading to a worsening macroeconomic situation. Over the past two decades, both inflation and interest rates have consistently exceeded those of comparable countries. The current high policy rate of 22% has severely limited the operational capacity of businesses, rendering borrowing costs prohibitively expensive for the local business community.

Pakistan's credit accessibility for the private sector, as a percentage of GDP, is notably lower than that of its regional counterparts due to exorbitant interest rates, the crowding-out effect, and stringent collateral requirements. Specifically, the country's policy rate is the highest in the region, with collateral requirements escalating to 150% of the total loan value, which notably restricts the growth of Small and Medium Enterprises (SMEs). Alarmingly, only 7% of Pakistani firms engage with formal lending institutions, a stark contrast to 21% in India and 34% in Bangladesh.

The transition to a flexible exchange rate system, as recommended by the IMF, has not produced the anticipated benefits. Instead, it has triggered significant volatility in the value of the Pakistani rupee. Since the adoption of this system in 2019, the rupee has depreciated by approximately 102.25%, without a corresponding positive impact on the balance between exports and imports. Notably, in 2023, the Pakistani rupee was ranked as the poorest-performing currency in Asia

Empirical evidence suggests that, on average, a 1% increase in discount rate increases the inflation by 1.3% and increases debt servicing by Rs. 200-250 billion annually.

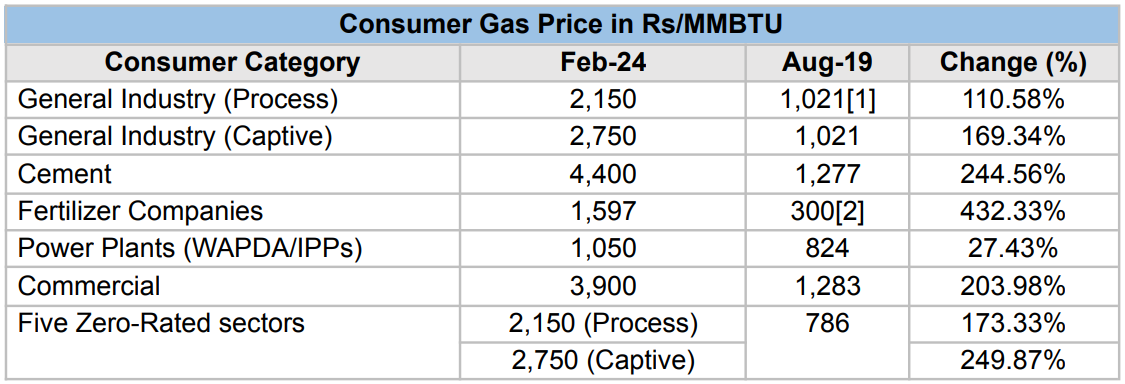

Gas Prices

In 2019, Rs786 per MMBTU was charged from registered manufacturers or exporters of five zero-rated sectors and their captive power namely: Textile (including jute) carpets, leather, sports, and surgical instruments. Thus, as of now the prices for the above-mentioned industrial units have increased by 249.87% for those with captive power generation and by 173.54% otherwise.

The gas prices for the fertilizer sector have increased by 432.33% since the August 2019 gas tariff notification. It has become hard for industrial units to operate in such a hostile environment.

Electricity Prices

Despite all governance failures, the estimated Cost of Service of electricity to industrial consumers is Rs25.86/kWh but on average industrial consumers are subject to Rs34.47/kWh as a base tariff. If we include monthly fuel cost adjustment and quarterly tariff adjustment, it is between Rs40/kWh to Rs45/kWh.

In FY2020-21, industrial consumers paid Rs81 billion in cross-subsidization whereas for FY2023-24 it is estimated that industrial consumers will pay Rs244 billion in cross-subsidization.

Recommendations

SBP should focus on core inflation rather than general inflation on an immediate basis as these exclude the most volatile components of the basket.

The government must ensure the effectiveness of price control measures through an active Competitive Commission of Pakistan, a robust price control magistracy system, and vigilant actions against hoarding and malpractices.

The power tariff for industrial consumers is not regionally competitive. Industrial consumers should be charged with the actual cost of electricity which is estimated to be at Rs25.86 per kWh. The cross-subsidization mechanism must be abolished it is hurting the economy.

Due to a significant increase in capacity charges, amounting to 71.8% of the power purchase price for FY-2023-24, urgent measures are required. The government of Pakistan should prioritize renegotiating power purchase agreements with Independent Power Producers (IPPs) to extend the debt repayment period.

Brig Iftikhar Opel, SI (M), Retd.

Secretary General